Looking for Condo Insurance in St Louis?

Unit owner’s insurance is tailored to meet the unique coverage needs of households living in attached units such as condominiums. Unit owner’s insurance is similar coverage to homeowner’s insurance in that it can protect the structure as well as the contents of your home.

In many circumstances, the condominium association or similar community association in your development may provide coverage for the physical building and structure. In this case, your policy would need to cover just those risks not protected by the community association insurance. The deductible for your community association’s insurance may be very high. Unit owner’s insurance can help you lower your out of pocket cost in the event of a loss by covering all or part of the deductible.

As a unit owner you need coverage that matches your budget and risk.

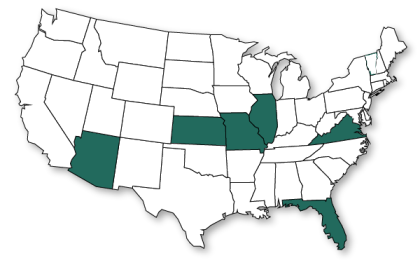

Our team will will help you understand what policies are protecting your unit and where there might be gaps in your coverage for contents and liabilities associated with being a property owner. As an independent insurance agent, O’Connor insurance can make sure you are getting the best value from your unit owner’s insurance dollar.

Condominium, duplex, lofts, attached unit, O’Connor insurance will take the time to understand your property and neighborhood to write the policy you need to help you protect the property against common disasters, such as:

- Fire: Often smoke damage and water damage is far greater than the actual fire, especially to your belongings like furniture and decor.

- Lightning: A lightning strike could do a great deal of damage to your home’s electrical system and all the electronic devices from household appliances to computers and entertainments systems.

- Weather: Wind, hail storms, ice storms can destroy more than roofs. Winds can knock over trees, down power lines and cause all sorts of damage indirectly as well as directly.

- Flood: When you are in a flood zone, over 20% of flood claims are filed outside of the flood zone. Flood is excluded on Unit Owner’s policies.

- Crime: Theft, vandalism and other malicious acts can cost the unit owner a great deal.

- Accidents: Unit owners have suffered substantial losses as vehicles have crashed into their building. These and other accidents happen all the time.

- Civil Liability: Unit owner’s coverage can provide protection against lawsuits and legal expenses.

A well-written policy will take into account your property, the age of your unit, other structures, the value of your personal possessions and your budget to provide the kind of protection that will lend peace of mind to you and your family.

Contact O’Connor Insurance to review your existing coverage. We want to make sure you, your family, your property and your future are secure.

Too Good To Be True

How to get started on your quote

To get started on your quote, call our office or click over to our quotes page. Either way we’ll make the process simple!